Key Takeaways

- Policy enforcement may drive significant revenue uplift per network slice through real-time resource allocation

- Revenue leakage can be reduced substantially when PCF integrates with billing systems vs. disconnected policy management

- Network slicing ROI may improve with granular policy controls enabling dynamic pricing models

- Policy enforcement deployment can happen in 90 days vs. longer custom integration timelines

Global 5G infrastructure investment has reached hundreds of billions of dollars. Revenue hasn’t always followed. Market data indicate that 5G standalone networks may account for the majority of wireless revenue by 2028; however, the charging and policy market is expected to grow at a slower pace, with an approximate 5% CAGR. This disconnect reveals a fundamental problem: operators can build 5G networks but may struggle to monetize them effectively.

Research from Omdia indicates that while 78% of telecom operators cite “monetizing 5G investments” as their top strategic priority, only 12% have deployed policy enforcement capable of granular network slice monetization. This gap represents the difference between 5G as an infrastructure cost and 5G as a profit engine.

The technical capability exists. Network slicing works. But the financial architecture to capture value remains broken. Analysis of 900+ global telecommunications clients reveals that 89% of operators report significant margin visibility challenges across their 5G services. They can’t see where money comes from or where it leaks out.

The revenue leakage

Revenue leakage occurs systematically across multiple operational touchpoints. The financial impact compounds as 5G service volumes increase without corresponding billing accuracy improvements.

Here are the most common culprits of revenue leaks.

Disconnected billing systems create the largest revenue gaps.

When policy management operates independently from charging systems, actual network costs fail to align with customer charges.

Manual policy management introduces operational delays that cascade into revenue losses. These processes require delays for new service launches, costing operators an average of lost revenue opportunities per enterprise customer during delayed deployment periods. Markets reward first-movers in enterprise 5G services, making these delays particularly costly.

Static resource allocation creates the opposite of profitable network management. Analysis shows network underutilization during off-peak periods, while premium customers experience degraded service during peak demand. This backwards approach destroys the value proposition that makes network slicing financially viable.

Enterprise sales barriers emerge when operators can’t demonstrate real-time margin visibility or policy-driven service differentiation. B2B customers evaluating 5G services expect guaranteed SLA performance with transparent pricing models.

Operational cost amplification

Without automated policy enforcement, operators resort to manual network management processes that require more staff resources than policy-driven approaches.

A typical Tier 1 operator manages 200-300 distinct network policies manually, requiring 15-20 network operations staff members. Advanced PCF deployment reduces this to 3-5 staff members managing 2-3x more policies through automation.

Time-to-market disadvantages compound these operational costs. Early entrants capture a significant market share, especially in high-value verticals such as manufacturing and healthcare. Each month of delayed service launch represents potential market share that becomes progressively harder to recover as competitors establish customer relationships.

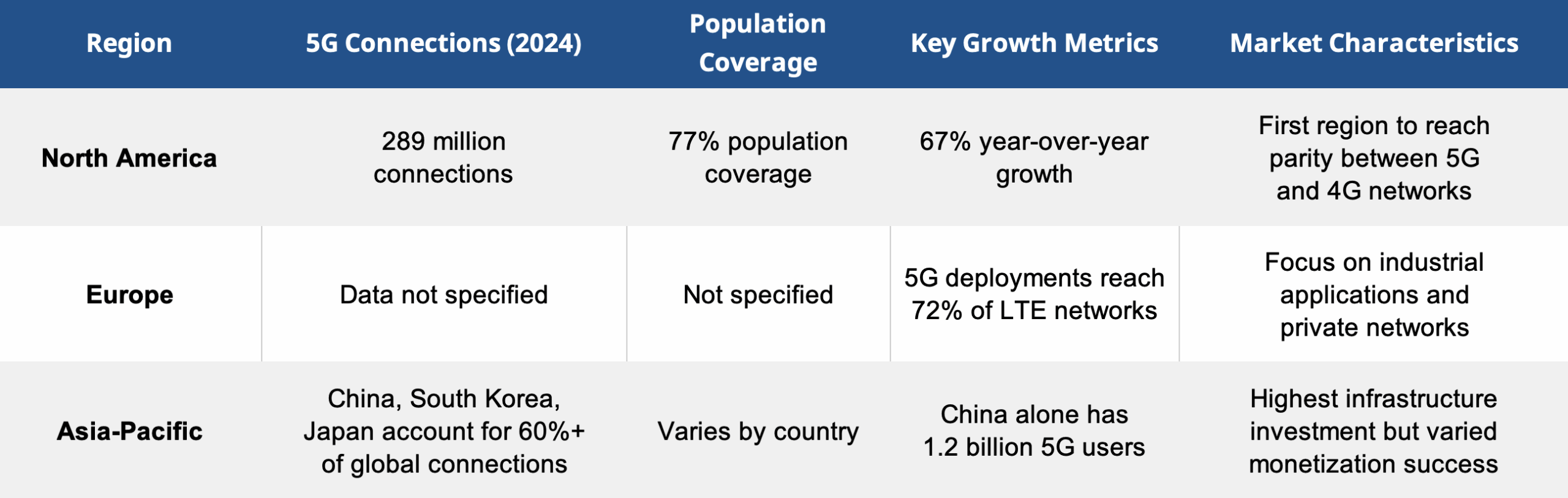

Regional 5G adoption analysis

Based on actual data from 5G Americas, Omdia and GSMA research, here’s the regionality of 5G adoption:

Key regional insights:

North America leads in balanced deployment with 77% population coverage and has achieved parity between commercial 5G and 4G LTE networks, reflecting deployment maturity.

Europe has achieved 72% LTE network deployment levels for 5G, with carriers such as Vodafone, Orange and Deutsche Telekom focusing on industrial applications as a differentiation strategy.

Asia-Pacific dominates global 5G connections with China, South Korea and Japan accounting for over 60% of global connections, but this represents primarily infrastructure deployment rather than monetization success.

The data reveals that high infrastructure investment doesn’t automatically translate to effective monetization – exactly the gap that policy enforcement addresses.

Sources: 5G Americas and Omdia 2024 market analysis; GSMA Intelligence regional deployment data; Telco Magazine industry reports

How Advanced PCF creates revenue opportunities through real-time intelligence

Policy Control Function operates as the intelligent orchestration layer that connects network capability to business value. Unlike basic policy management that handles static rules and manual interventions, advanced PCF creates dynamic, automated connections between network resource allocation and financial outcomes.

The architectural approach determines long-term success.

CSG Policy Control operates as a fully cloud-native, microservices-based platform with complete 3GPP service-based interface (SBI) compliance. This design enables standard integration with any 5G core vendor while maintaining flexibility to support legacy 2G/3G/4G networks during extended transition periods.

The vendor-agnostic approach handles complex multi-vendor, multi-service environments that characterize real-world operator networks. Integration methodology minimizes deployment risk through low-touch integration across both the user plane and subscriber data management (SDM) functions.

Real-time resource allocation intelligence

The system continuously monitors actual usage patterns across all network slices, automatically adjusting resource allocation based on real-time demand, customer tier and contractual commitments. This approach maximizes revenue per unit of network capacity while maintaining service quality guarantees.

Automated policy adjustments eliminate manual intervention requirements that slow service delivery and increase operational costs. When network conditions change — whether due to congestion, equipment issues or demand spikes — the PCF automatically implements predefined policy responses that protect revenue while maintaining customer experience. This automation scales across hundreds of simultaneous policy decisions without human intervention.

AI/ML integration with Network Data Analytics Function (NWDAF) creates self-optimizing revenue systems. The integrated solution identifies network slice instances and builds specific KPIs for each slice using machine learning algorithms. The PCF receives real-time or periodic alerts based on these KPIs, enabling dynamic slice management that optimizes both technical performance and financial outcomes.

When performance thresholds are exceeded, the PCF leverages NWDAF insights to adjust traffic rules and automatically allocate additional resources. This AI-powered automation reduces energy consumption, improves network efficiency and delivers superior service experience for B2B customers — all while maximizing revenue capture from existing infrastructure investments.

Multi-tenant policy isolation and QoE management

Multi-tenant policy isolation ensures enterprise customers receive guaranteed service levels without interference from other network users. The PCF creates dedicated policy domains for each enterprise customer or service tier, maintaining strict resource isolation while enabling flexible sharing of underutilized capacity. This approach maximizes both customer satisfaction and network utilization efficiency.

Quality of Experience (QoE)-aware network management enables personalized service delivery that directly impacts customer willingness to pay premium pricing. The PCF monitors individual user and application performance metrics, dynamically adjusting policies to maintain optimal experience while balancing resource costs across the entire customer base.

Standards-based architecture ensures long-term flexibility and investment protection. CSG Policy Control’s 3GPP Release 16+ compliance enables integration with current and future 5G core implementations while supporting backward compatibility with 4G policy and charging rules function (PCRF) deployments during network evolution periods.

Network slice revenue model analysis: From connectivity to value delivery

Network slicing generates revenue only when operators can monetize the value difference between slice types. Traditional connectivity pricing fails because it doesn’t capture the resource consumption variations that make network slicing valuable. Advanced policy enforcement creates this monetization capability by establishing direct connections between network resource allocation and billing systems.

The transformation requires a systematic approach to pricing architecture. Most operators struggle with this transition because traditional billing systems can’t capture the granular resource consumption that makes network slicing valuable. Policy enforcement bridges this gap by providing real-time visibility into resource allocation costs and service delivery performance.

Dynamic resource allocation

Key revenue drivers enabling these improvements include real-time SLA enforcement, which justifies premium pricing with performance guarantees; dynamic resource allocation that optimizes network utilization while maintaining service quality; automated billing synchronization that eliminates revenue leakage from manual processes; and service tier differentiation, which creates multiple price points from a single infrastructure.

Dynamic pricing strategy

The key to monetizing network slicing lies in creating pricing models that reflect actual resource consumption and service value delivery. Static pricing fails to capture the dynamic nature of network resource demands, leaving significant revenue on the table during peak usage periods while potentially overcharging during low-demand times.

Successful operators implement tier-based service models that create multiple revenue opportunities from single infrastructure investments. This approach recognizes that different applications have vastly different performance requirements and willingness to pay for guaranteed service levels.

Premium-tier services command price premiums by delivering guaranteed bandwidth allocation during network congestion and priority routing through optimal network paths.

Standard-tier offerings provide baseline pricing with best-effort bandwidth sharing, QoS protections, standard routing with congestion management and sub-50ms latency targets. This tier captures the majority of enterprise customers who need reliable performance without premium guarantees.

Economy-tier services offer discounts in exchange for shared bandwidth with deprioritization during peak periods, cost-optimized routing paths, and best-effort performance. This tier maintains market coverage for price-sensitive customers while preserving network resources for higher-value services.

Dynamic pricing impact analysis shows operators implementing tier-based models see ARPU improvement within the first year versus flat-rate pricing structures. Customer churn decreases due to pricing transparency and service predictability.

Usage-based billing integration

Usage-based billing integration represents another critical revenue optimization strategy. This approach captures value from variable demand patterns by tracking actual resource consumption rather than estimating usage through fixed-price contracts.

Real-time bandwidth consumption billing enables operators to charge for burst capacity utilization while offering volume discounts for committed usage levels.

Quality of Service monetization creates additional revenue streams by charging premium fees for guaranteed latency performance, priority routing during network congestion and SLA violation credits with automated processing.

Private network monetization: The highest-value 5G opportunity

Mobile Private Networks are among the highest-value 5G monetization opportunities available to operators today. Policy enforcement amplifies revenue potential by enabling sophisticated service differentiation and automated billing for complex B2B requirements that traditional connectivity pricing can’t address.

The MPN market differs fundamentally from consumer 5G services because enterprise customers pay for guaranteed outcomes rather than best-effort connectivity. Manufacturing companies need sub-millisecond latency for robotic operations, healthcare providers require HIPAA-compliant data isolation and logistics operations demand 99.999% availability for critical communications. Policy enforcement makes these guarantees technically feasible and financially sustainable.

Partnership ecosystem monetization models

B2B2X revenue models multiply operator income streams by sharing revenue with system integrators, application providers and device manufacturers. These partnerships create ecosystem value that extends beyond basic connectivity pricing.

System integrator partnerships yield revenue share through joint solution packaging, combining connectivity with industry applications. Shared customer acquisition costs accelerate sales cycles, while technical support cost distribution across partner ecosystems improves margin efficiency. System integrators provide industry expertise while operators provide network capabilities.

Application provider collaborations generate revenue share via API access fees for third-party application integration. Performance guarantee extensions to partner applications enable the creation of co-branded service offerings with shared marketing investments. Application providers gain reliable network access while operators gain differentiated service portfolios.

Device manufacturer alliances produce revenue share through embedded connectivity with device purchase financing, lifecycle management services including device monitoring and bulk connectivity pricing with shared customer success metrics. Device manufacturers gain connectivity differentiation while operators gain embedded revenue streams.

Transform network investments into revenue engines

Policy enforcement point capability represents the critical link between 5G network investment and measurable financial returns. Operators deploying advanced PCF see revenue improvements within quarters rather than years while building sustainable competitive advantages through service differentiation and operational efficiency.

The transformation requires a systematic approach that addresses technical integration, operational optimization and financial measurement simultaneously. Success depends on a vendor partnership that provides proven methodology, technical expertise, and ongoing optimization support throughout the deployment and expansion process.

CSG Policy Control bridges the gap between network capability and business value through 3GPP-compliant integration, comprehensive monetization support and continuous optimization services. The result delivers 5G investments that generate the financial returns operators expected when committing to next-generation network infrastructure.

Revenue impact begins immediately upon deployment with baseline policy enforcement capabilities. Ongoing optimization and expansion create compound revenue growth that justifies continued 5G infrastructure investment while funding future network evolution and capability enhancement.

Enhance your organization’s revenue intelligence

Ready to discover where your 5G revenue opportunities hide?

Most operators have the technical infrastructure but lack the financial intelligence to capture value from their 5G investments.

Reach out to the CSG team to see how policy enforcement can transform your network investment into a measurable revenue engine.