“Change is the only constant in life.” The telecommunications market is undergoing a seismic shift, and the competition is reaching new heights of intensity. In this dynamic landscape, cable providers are bravely adapting to the challenges posed by streaming services and emerging technologies. 3 trends specifically, are not only shaping the future of the North American cable industry but also redefining the very notion of connectivity.

Trend 1: The Broadband Revolution – Thriving Amidst the Streaming Storm

In the early 2000s, traditional linear TV dominated households, but the times have irrevocably changed. The streaming revolution has seen many cord-cutters abandon cable or satellite TV in favor of on-demand or streaming service providers from the likes of Netflix and Hulu. As the scales tipped in July 2022, streaming accounted for 34.8% of television viewing, surpassing cable’s 34.4% share.

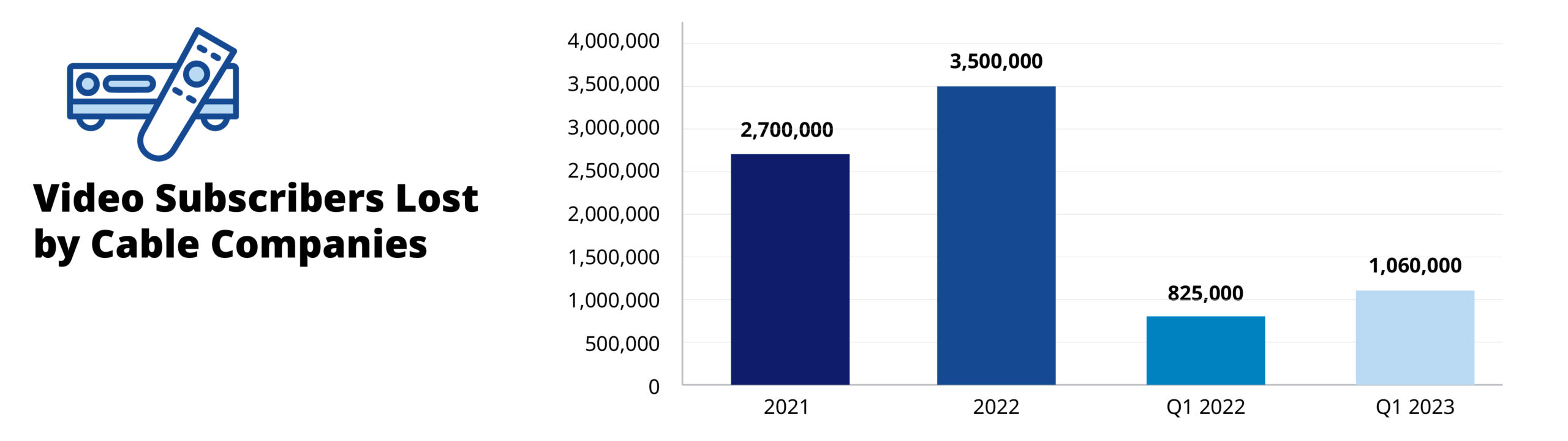

This rapid transformation led to a decline of 8.5% in cable video subscribers in 2022 alone, pushing cable operators to think boldly and outside the box. One solution is to double down on broadband business, a strategic move that has seen them lay fiber networks across the US, redefining internet connectivity. Fiber broadband service offers lightning-fast, reliable internet and unprecedented scalability, giving US cable companies a competitive edge to combat video subscriber losses.

With the pandemic driving demand for home internet, cable providers witnessed an unprecedented surge in broadband subscribers in 2020. Though the growth rate has slowed, they managed to add approximately 515,000 subscribers in 2022. This trend not only represents the resilience of cable providers but also their willingness to embrace new opportunities.

Source: Leichtman Research Group

Related Blog: Revenue-Generating AI Use Cases: A Primer for CSPs

Trend 2: Wireless Warriors – Carving Their Niche in Broadband

The battleground for connectivity has expanded as wireless providers like AT&T, Verizon, and T-Mobile look to compete in a new way in the broadband market with the introduction of Fixed Wireless Access (FWA). Utilizing radio frequencies instead of traditional cables, FWA empowers network operators to deliver ultra-high-speed broadband to suburban and rural areas, where laying fiber was once deemed financially prohibitive.

In 2022, Fixed Wireless/5G home Internet services from T-Mobile and Verizon added a staggering 3,170,000 subscribers, accounting for 90% of net broadband additions that year. This formidable entry from wireless providers has caused ripples of concern within the cable industry, prompting them to adapt their strategies to stay ahead.

Trend 3: The Uncharted Frontier – Cable Companies Go Wireless

In the spirit of “if you can’t beat them, join them,” cable providers have seized the opportunity by entering the wireless domain. Leaders like Comcast and Charter set foot in the wireless realm back in 2020, and the sixth-largest US cable provider, Astound Broadband, has recently launched Astound Mobile service, with plans to serve four million homes using T-Mobile’s network.

Why this sudden shift to wireless? Because the mobile service revenue pool is nearly 2.5 times greater than residential broadband [CD6], offering an enticing prospect for cable companies. By bundling TV, broadband, home security, and wireless services, they create an all-in-one connectivity package that entices customers with competitive pricing. This bold move is paying off, with US cable companies grabbing an ever-growing share of the wireless market.

Related eBook: CX Market Leaders in Telecoms

The Key to Success: Wi-Fi Offloading – A Bold Money-Saving Strategy

To survive and thrive in the wireless market, cable companies have had to forge strategic MVNO partnerships with mobile network operators like Verizon, AT&T, or T-Mobile. However, these partnerships come at a cost. To maintain competitive prices while offering unlimited mobile services, cable providers have devised a game-changing strategy – Wi-Fi offloading.

By offloading customer data onto Wi-Fi networks, cable companies significantly reduce their expenses related to MVNO partnerships. For example, Charter has estimated that about 85% of traffic for Spectrum Mobile was running on its own network, resulting in substantial savings. This bold approach has proven to be a game-changer in the fiercely competitive wireless market.

Additional Strategies to Consider:

- Enhance Customer Experience: By providing outstanding customer service and personalized offerings, businesses can gain a competitive advantage through integrated experiences. Utilizing real-time customer journey management allows for individual-level management of customer journeys across multiple devices. These journeys can include targeted promotional offers, service bundling, and prompt bill issue resolution.

- Leverage Network Investments: Explore opportunities to harness the power of the network and new connectivity offering to include Internet of Things (IoT) to offer innovative services like smart home solutions, connected devices, and immersive entertainment experiences.

- Invest in Data Analytics: Use data analytics to gain deep insights into customer preferences, behavior, and trends. This data-driven approach can help optimize service offerings and target marketing efforts more effectively.

CSG: Your Guide to Conquering the Wireless Frontier

Amidst the shifting landscape and intense competition, the need for expert guidance becomes paramount. CSG stands at the forefront, dedicated to supporting North American cable operators in this pivotal moment. We provide the expertise and monetization and customer engagement solutions needed to navigate industry challenges and unlock new opportunities in the wireless space. With CSG as your strategic ally, you can boldly embrace the future of the cable industry.