As companies move mountains during digital transformation, it’s easy to overlook the basics. They’re overhauling how they interact with consumers using conversational AI, predictive analytics and other technology to reinforce brand loyalty and reduce costs. These moves are necessary, yet companies shouldn’t forget about the less tech-heavy opportunities for improving the customer experience (CX) amid their transformation.

Back to the basics.

Bill design is one of the basics that can make a huge difference in 1) a customer’s relationship with the brand and 2) the company’s bottom line. A monthly bill is a marketing asset that reaches customers up to 12 times a year—not just a document that gets a company paid. A more customer-centric statement reduces billing calls to the contact center (in ADT’s case, by 20%). A better billing statement also increases on-time payments and reinforces customer loyalty, among other potential benefits.

What makes a billing statement better? Drawing from 130 consumer studies, CSG developed an assessment to evaluate bill design based on the criteria consumers look for in their statement. Then using the assessment, we scored bills from 30 different organizations in communications services, utilities and other industries.

The findings were surprising. Many of the most basic consumer requirements were commonly missed among the 30 bills tested. You can read the full “5 Billing Statement Sins” eBook, but for this blog we’ll dive into Sin #2: not providing a clear due date.

THE DUE DATE: MINOR DETAIL, MAJOR IMPACT

Aside from the amount due, the due date is rated by consumers as the most important information on their bill. How companies present the due date on a bill might sound insignificant—it’s just a couple words—but getting it wrong is quite common. Ambiguous due dates carry repercussions for customers (avoidable late fees, time spent calling customer service and frustrating experiences) as well as companies (higher call volumes and eroded customer loyalty).

CULPRIT 1: “DUE BY”

A bill makes its due date clear when it’s explicit about when the payment would be late. A phrase that doesn’t do that, yet shows up on bills all the time, is “Due By” (and its various forms including “Please pay by x date”).

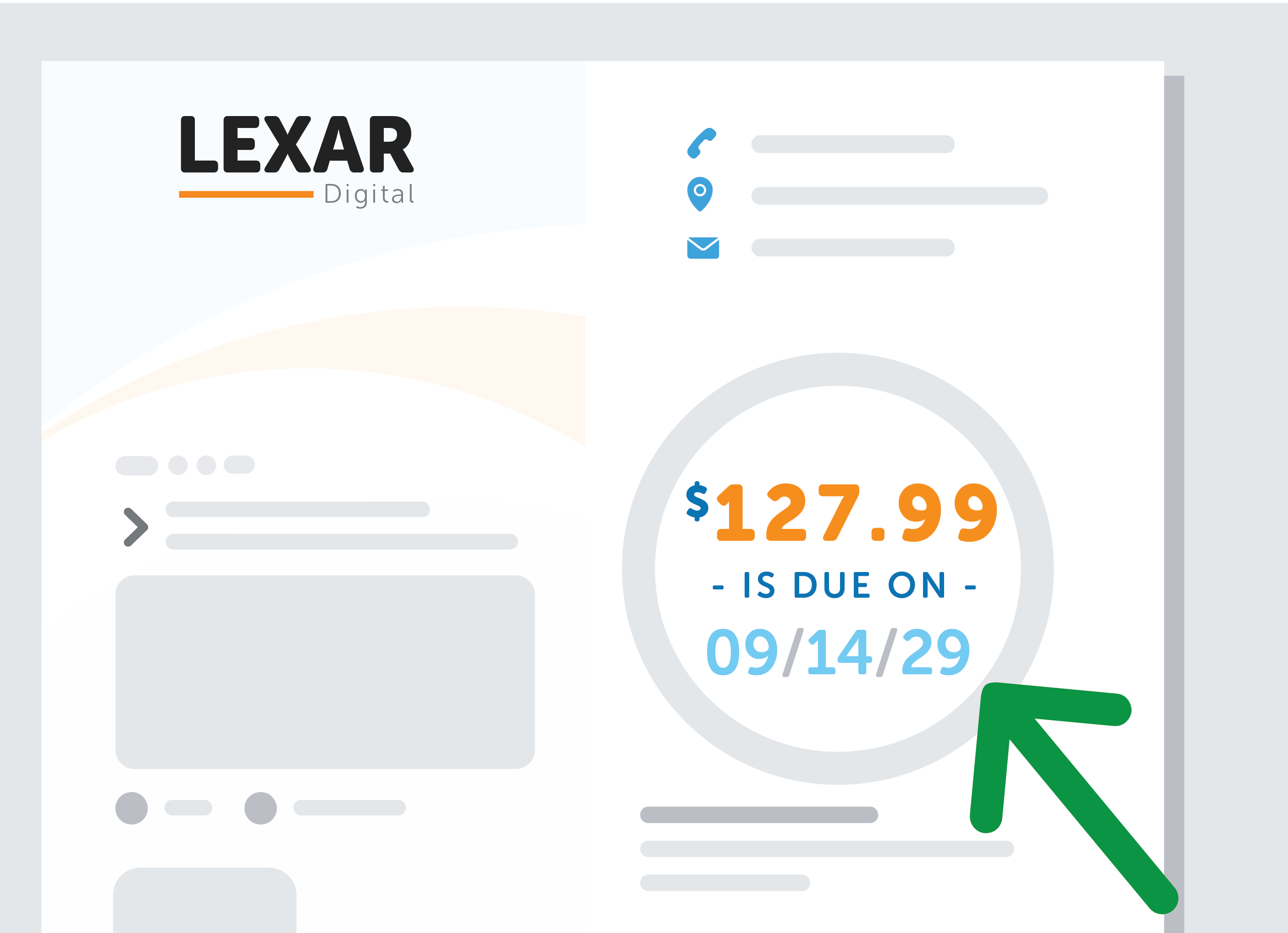

Look at the example we mocked up below. If you received this bill, could you tell for sure when your payment would be late? Is it still on time if you pay on September 14? Or does the payment become late on September 14?

CULPRIT 2: “DUE UPON RECEIPT”

Another phrase we see on bills is “Due Upon Receipt” instead of a due date, which communicates urgency, but not clarity. It’s unclear to the consumer what day the company considers the bill “received.” Is it when it reaches the consumer’s mailbox, or when they open the envelope and read it? If it’s a digital bill, does receipt happen when it hits the consumer’s email account (even if it ends up in their spam folder)?

CULPRIT 3: AUTOPAY IN PLACE OF DUE DATE

Companies also complicate the due date for customers when they use the autopay date in its place. Of course, those are almost always different dates, and autopay doesn’t make the due date irrelevant. Suppose a customer wants to turn off autopay one month: the bill won’t tell them when they have to submit a manual payment that month to avoid a late fee.

HOW TO IMPROVE THE BILL DESIGN

The fix is to keep the language clear and simple, and avoid the phrase “Due By” (or “Please Pay By” or other similar versions) in favor of “Due On,” “Due Before” or even just “Due.” That helps eliminate the unnecessary ambiguity about when a payment becomes late.

For customers on autopay, it’s good practice to include the autopay date: some might worry that the fact they’re receiving a statement is an indication they’re not on autopay. We just recommend including the due date with it.

Why do so many bills avoid the simplest, clearest language? One reason, we find, is that companies sometimes fix something that isn’t broken in an effort to differentiate the consumer’s experience. It could be the wording on a bill, or it could be the UI on an online portal. If consumers had their choice, they would likely prefer that the bill just say “Due.” So why would a company choose different over best?

Of course, what’s “best” in the eyes of consumers isn’t often clear cut. But companies can uncover what consumers want by using their voices to guide their CX strategy. That’s where CSG Communication Design & Delivery can help. Using proven methods in billing research, strategy and innovation, we help organizations like yours uncover key consumer behaviors, needs and pain points to help you exceed their expectations.

To see the rest of the Billing Statement Sins, and how to fix them, download this free eBook.